Round2 Capital: first closing of €100 million software lending fund

Luxembourg/ Vienna (ÖS) — Round2 Capital completes first closing of € 100 million software lending fund. The company’s second fund targets European growth companies offering B2B software that is critical to business success and typically generates €5–25 million in recurring annual revenue.

European software investment house Round2 Capital closes the first part of its second software lending fund with €62 million, bringing its total assets under management to €115 million. Round2 Capital is a leading pan-European software lending firm that employs an actively managed, revenue-based lending strategy and has invested in more than 25 companies across 8 European countries.

The Luxembourg-based Round2 Capital Fund II applies the same successful strategy as Round2 Capital’s fully invested first software lending fund and has a target of €100 million. The second vehicle will finance up to 40 small and medium-sized software companies across Europe, with a focus on the DACH and Nordic markets.

With its business-friendly, revenue-based financing approach, Round2 Capital enables software companies to convert their recurring revenue into flexible growth financing that allows these companies to secure capital without dilution, loss of control or restrictive covenants.

Round2 Capital takes a long-term approach and is an active partner to its portfolio companies, providing hands-on support for the key operational challenges SaaS companies face in the critical stages of their development to reach €50M ARR. As of November 2022, Round2 Capital Fund I has no defaults and 4 exits.

Round2 Capital Fund II investors include various family offices and institutional investors from Europe and the USA. The anchor investor is the European Investment Fund (EIF), which will be represented on the fund’s board of directors.

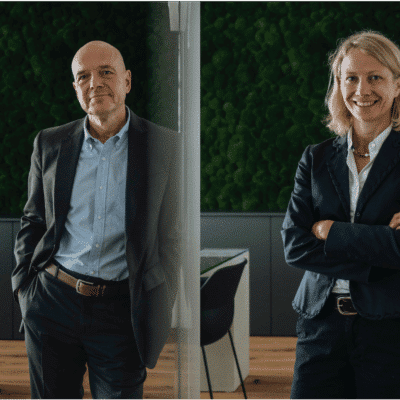

— The fund is managed by Christian Czernich, Jan Hillered, Isabella Hermann-Schön and Stefan Nagel, who were already responsible for managing the first cohort. You will be part of a growing 11-person team that operates the Round2 Capital software lending platform. www.round2cap.com